Bam! Post 2 in our research series (post 1 can be found here)!! After 3 months of collecting, verifying, and analyzing data for the 2016 MVCA Research Report – there are a few trends that have me scratching my head. So this year, we’re turning to the community – every quarter I’ll walk you through my line of thinking and trends on a particular topic and will ask for your interpretation. This week we have responses from Jon Oberheide (Duo Security), Adrian Fortino (Mercury Fund), Ryan Vaughn (Varsity News Network), Hugo Braun (NorthCoast Technology Investors), Dale Grogan (Michigan Accelerator Fund). This week I’m wondering about follow on funding…

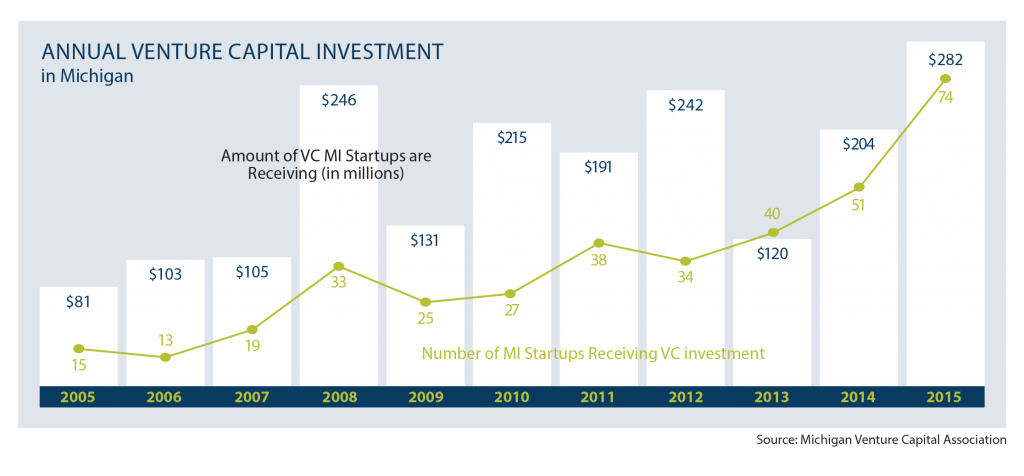

Michigan’s 36 venture firms have participated in nearly 100% of the venture capital rounds raised by startup companies in Michigan. The number of companies receiving venture capital each year has nearly doubled in the last five years and quadrupled what it was ten years ago.

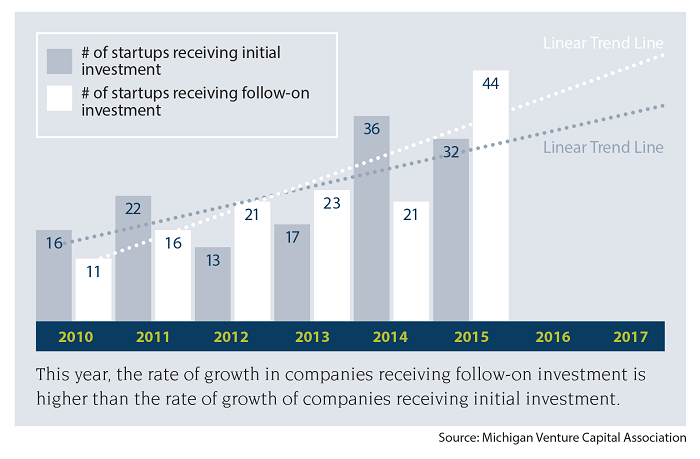

In 2015, there were 74 unique companies that received venture capital financing – but this is not the number of investments made, it’s the number of companies. In 2015, there were 70 follow-on investments made into 44 Michigan startups and 40 initial investments made into 32 Michigan startups. For our purposes, initial investment is defined as the first time a venture firm invests in a company and follow-on investment is defined as the second time (or more) that same venture firm invests in that same company.

When looking at the number of companies receiving an initial investment or a follow-on investment during 2015, there is a small change in the trend line that I started noticing in 2013. Nothing to call the authorities about, but in 2012 and prior, the trend was that more Michigan startups received an initial investment from a Michigan venture capital firm than a follow-on investment. However, starting in 2013, the trend has flipped (see where trend line crosses in the chart below) and I would expect it to stay that way going forward.

When looking at the number of companies receiving an initial investment or a follow-on investment during 2015, there is a small change in the trend line that I started noticing in 2013. Nothing to call the authorities about, but in 2012 and prior, the trend was that more Michigan startups received an initial investment from a Michigan venture capital firm than a follow-on investment. However, starting in 2013, the trend has flipped (see where trend line crosses in the chart below) and I would expect it to stay that way going forward.

The great news is that the number of initial investments continues to trend up meaning the entrepreneurial community is growing! But what does this emerging trend where follow-on investments are more common than initial investments mean for Michigan? A few hypotheses I’ve been thinking about:

- This is another sign of a maturing entrepreneurial and investment community. Michigan has great companies and investors are continuing to fund them as they mature and rapidly meet growth milestones. Michigan venture firms are similarly maturing into their second and third funds, and any prior funds that aren’t fully deployed are now doing only follow-on investments.

- Entrepreneurs in Michigan are seeking investments from outside of Michigan more frequently. This is supported by the trends we discussed in the first post of the research series. Investment from out-of-state is matching in-state investment at a ratio of 4.3 to 1 and that is a ratio that also seems to be growing over time. However, Michigan investors are still making an increasing number of initial investments, so this hypothesis might do a better job of explaining a trend in the capital deployed to follow-on investments instead of the number of investments.

Startup companies are not moving to the next stage of capital after receiving an initial investment, so companies need more capital from existing investors to keep them going. Some companies are needing multiple follow-on investments from their existing investors to build their companies on. This could mean a lot of different things – maybe capital at later stages isn’t available; maybe Michigan investors are making too small of initial investments so they drag it out over more tranches than investors elsewhere would; maybe Michigan investors believe so much in their portfolio companies they are eager to have the chance to continue to have a seat at the table…or a combination of those?

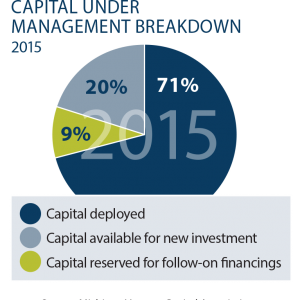

Startup companies are not moving to the next stage of capital after receiving an initial investment, so companies need more capital from existing investors to keep them going. Some companies are needing multiple follow-on investments from their existing investors to build their companies on. This could mean a lot of different things – maybe capital at later stages isn’t available; maybe Michigan investors are making too small of initial investments so they drag it out over more tranches than investors elsewhere would; maybe Michigan investors believe so much in their portfolio companies they are eager to have the chance to continue to have a seat at the table…or a combination of those?- Maybe “capital available for new investment” is truly drying up, so venture firms are tending to nurture their existing portfolio companies, make new investments very sparingly, and pray for an exit to jump start fundraising for their next fund? (See pie chart)

So, here is a question that the data behind the 2016 MVCA Research Report raises in my mind:

What does it mean when an entrepreneurial community starts seeing more follow-on investments than initial investments?

Responses:

Jon Oberheide, Co-Founder & CTO, Duo Security

Jon Oberheide, Co-Founder & CTO, Duo Security

Duo Security is an IT company that has offices in Ann Arbor, San Mateo, Austin and London

The optimistic investor might claim that more follow-on investments indicates that more Michigan startups are seeing sustained success to be able to receive additional financing rounds. The pessimistic investor might claim that new deal flow is limited, leading to more capital to tilt towards follow-on vs. new opportunities. The truth may be somewhere in between, but with limited sample size and without considering the dynamics of fund lifecycles, anecdotal evidence may be more compelling than a few data points.

At Duo, it was important to have a local Michigan investor (Resonant Ventures) participate in our initial and follow-on financings to round out an otherwise West Coast VC line-up. Participating in, instead of competing to lead, an initial round alongside other name-brand firms has numerous benefits for Michigan VCs: de-risking future capital raises, more deal flow through syndication, and exposure to market terms that Michigan startups are seeing from out-of-state firms.

At the end of the day, the increase in follow-on investments and overall growth is objectively modest, but still positive to see. It will take larger catalysts in the Michigan capital environment and community to really take off.

Adrian Fortino, Partner, Mercury Fund

Adrian Fortino, Partner, Mercury Fund

MVCA member, Mercury Fund is a Michigan and Texas-based venture capital firm that actively invests in startups nationwide

The data is not segmented by stage so it’s tough to really answer the questions posed in the blog but I believe we have two compounding issues that caused this new investment drop last year.

- I suspect the # of new investment reduction from last year is mostly (if not all) from a big drop off in the pre-seed/seed stage. Based on anecdotal information, most of our region’s pre-seed/seed new investments dry powder is gone. We were fortunate enough to have a number of foundations and the state government invest in very early stage funds several years ago, but most of that is fully allocated. Hopefully, some of those dollars will begin to free up and/or there will be re-ups in these early stage funds, but it won’t be anywhere near the level it was in years past.

- The macro slowdown in tech that started last year on the coasts is now hitting the middle of the country. It’s unclear how significant those trends will continue to affect us here in Michigan, but a lot of investors across the country have been reducing the number of companies in each fund and increasing the follow on reserve capital for the last 12-18 months so that dynamic has likely played into the increased follow on/new investment ratio.

Ultimately, I think we’re going to continue to see these reductions in number of investments in the early stages in the next two to three years as well.

Ryan Vaughn, Founder & CEO, Varsity News Network

Ryan Vaughn, Founder & CEO, Varsity News Network

Varsity News Network is a Michigan-based IT company that has raised capital from Michigan venture firms and angel investors

I think it could indicate a number of things, but I tend to believe it’s the result of successful companies maturing, particularly in the software industry. Over the last five years we’ve seen a corresponding trend in the relative maturity of a few leading startups across the state. That first cohort of companies has come of age, if you will, which creates opportunities for follow on investments that didn’t’ exist a few years ago, when the industry was young and there frankly weren’t many follow on opportunities. Successful Michigan companies are maturing, and investors are seeing the possibility of better outcomes in their existing portfolios than new investments.

Hugo Braun, Managing Director, NorthCoast Technology Investors

Hugo Braun, Managing Director, NorthCoast Technology Investors

MVCA member, North Coast is a Michigan-based venture capital firm that actively invests in Midwest startups

I see the trend toward more follow-on investments in Michigan very positively. High performing venture-backed companies typically require several rounds of financing before reaching a successful exit event. Startups that do poorly are often unable to raise follow-on financing, while successful startups are the ones able to raise multiple rounds. An increasing number of follow-on financings indicates an increasing number of successful startups.

Over the long run, one would expect the growth rates of initial investments and follow-on investments to be approximately the same. I believe the MVCA data supports this because the growth trend lines are too similar to indicate any real underlying difference in growth rates. The level of initial investments will likely be more variable because it is based only on current opportunities and market conditions that can change substantially from year to year. The level of follow-on investments will usually be more stable because it is based on the number of successful initial investments made over the previous several years, which smooths out shorter term fluctuations. This is exactly what the recent MVCA data shows.

Initial investments are a better leading indicator of the health of Michigan’s entrepreneurial climate than follow-on financings. Although the number may fluctuate significantly from year to year, as long as initial investments are trending upwards, our entrepreneurial climate is doing well. And if venture firms are initially backing the right companies, follow-on financings should show comparable healthy growth.

Dale Grogan, Managing Director, Michigan Accelerator Fund

Dale Grogan, Managing Director, Michigan Accelerator Fund

MVCA member, Michigan Accelerator Fund is a Michigan-based venture capital firm that actively invests in Michigan startups

From our perspective, this appears to be the natural cycle of venture investing in response to macro-economic trends. Part of the post-recession thaw was the founding of countless businesses. With so much opportunity, coupled with freshly raised capital from newly established funds, the natural outcome was a surfeit of early stage companies backed by venture funds in the 2011 – 2013 period. And given that over 50% of the deals considered by Michigan VCs are in the life science vertical, it is natural to expect that time from investment to exit is significantly longer than in other verticals such as software. This is due, in part, to the regulatory environment which demands lengthy and expensive clinical trials, validations, safety studies, etc. Companies that were initially funded in that 2011-2013 range are maturing, but not totally mature. VCs, as a rule, tend to support their portfolio companies that appear to be making progress towards relevant benchmarks. Our fund, the Michigan Accelerator Fund, has been no different. But as a small fund, we simply did not have enough capital to continue re-investing across the entire portfolio. In March of this year, we established the MAF Opportunity Fund with the idea that this new fund would be able to invest in the elite companies of the Michigan Accelerator Fund (albeit at different valuations), which have presumably been de-risked by hitting value inflection points. In other words, the Michigan Accelerator Fund portfolio had more capital needs than the Fund had capital to invest. So we will continue our follow-on investing until the funds have exits – which should roughly mirror to overall venture capital-back entrepreneurial company lifecycle, likely in 2017-2018. If this thought bears out, and the economy does not take an unexpected nosedive off a cliff, we would expect a new spate of startups in the 2017-2019 timeframe. This would mean investment into new companies, alongside continuous follow-on investment by venture funds.