After a whirlwind week spent launching the 2016 MVCA Research Report, Maureen, Emily and Molly hit the road for an MVCA Outreach Trip! Their destination? The Windy City, and a series of events connecting Michigan and Chicago-area venture and angel investors!

Visiting entrepreneurial & investment centers around the Great Lakes Region provides a great opportunity to connect Michigan investors with potential co-investors and build a stronger Midwest community. While in Chicago, MVCA hosted an investor-only networking reception for 45 local and Michigan investors in town for the Chicago Venture Summit. The event was a great success with over 15 different firms networking and building stronger ties between Illinois and Michigan.

On April 21st the MVCA team headed to Google to attend the Chicago Venture Summit. Highlights included a panel featuring the presidents of three major Illinois Universities discussing the growing entrepreneurial community in Illinois, a speech by Chicago Mayor Rahm Emanuel, a discussion with Steven M. LaValle a former principal scientist at Oculus, and a discussion on deep learning by Steve Jurvetson.

After the Summit came to a close, the team celebrated with IVCA Executive Director, Maura O’hare, and then woke early the next morning for a breakfast meeting with the fantastic Nicole Walker of Baird Capital (MVCA Member), Peter Johnson of Jump Capital (NEW MVCA Member as of this trip!), MATH Venture Partners, Energy Foundry, and Pritzker Group to go over the research report and better understand how their goals and investment strategies could align with the Michigan entrepreneurial and investment community. The day ended with a productive meeting with the amazing Michael Sachaj of Hyde Park Angels where MVCA associate director, Emily, formed a major data crush and the two teams shared ideas about the overlap between the angel and venture communities in Michigan and Illinois.

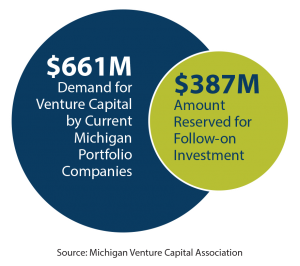

As detailed in the 2016 MVCA Research Report, Michigan venture capital professionals estimate that the 141 active venture-backed startups in Michigan will require more than $661 million in follow-on funding in the next two years. Venture capital firms in Michigan have earmarked an estimated $387 million for follow-on funding, so the additional money needs to come from both new funds raised by Michigan firms as well as out-of-state investment into Michigan. This makes outreach trips like the one to Chicago critical for attracting new investment dollars into the state and growing syndicate opportunities for our Michigan members.

As detailed in the 2016 MVCA Research Report, Michigan venture capital professionals estimate that the 141 active venture-backed startups in Michigan will require more than $661 million in follow-on funding in the next two years. Venture capital firms in Michigan have earmarked an estimated $387 million for follow-on funding, so the additional money needs to come from both new funds raised by Michigan firms as well as out-of-state investment into Michigan. This makes outreach trips like the one to Chicago critical for attracting new investment dollars into the state and growing syndicate opportunities for our Michigan members.

At each stop in Chicago, we gave an overview of the significant growth trends seen in the Michigan entrepreneurial and investment community and provided hard copies of the MVCA Research Report for reference. It was also useful to show the Chicago investors our newest tools, the Entrepreneurial & Investment Landscape Map and the Landscape Guide. Both should prove extremely useful in building a stronger bridge between the Chicago and Michigan investor communities.