Michigan Venture Capital Association extended its Great Lakes Region outreach earlier this week with a trip to Wisconsin for the Wisconsin Technology Council Entrepreneurs’ Conference. While there, MVCA Executive Director Maureen Miller Brosnan was hosted by Bram Daelemans, Director of the Wisconsin Angel Network, and visited with angels and venture investors who make Wisconsin their home.

On day one of our trip, Maureen met with investors who were interested in learning about MVCA and the significant growth trends we’ve seen in the Michigan entrepreneurial & investment community. It was interesting to hear perspectives on the tremendous opportunities people are seeing in across the Great Lakes Region. In a whirlwind day of meetings, we had the opportunity to talk to: Tim Keane, director of the Golden Angels Investors, Wisconsin’s largest angel group; John Philosophos, partner at early stage digital technology investor Great Oaks Venture Capital; Mark Bakken, founder and managing partner of early stage healthcare IT investor HealthX Ventures; Kyle Nakatsuji, Principal of American Family Ventures; Greg Robinson, managing director of early-stage tech investor 4490 Ventures; Maggie Brickerman, from an accelerator called Gener8tor; and Tracy Yaktus and Bob Wood, co-managers of angel group Wisconsin Investment Partners.

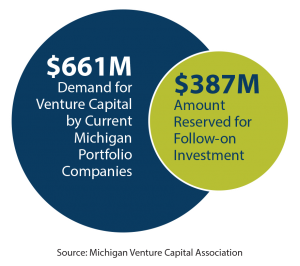

At each of our stops, we left Wisconsin investors with our newest MVCA tools, the Entrepreneurial & Investment Landscape Map and the Landscape Guide. The 2016 MVCA Research Report provided some relevant metrics about the opportunities out-of-state investors can find in Michigan: 141 active venture-backed startups in Michigan will require more than $661 million in follow-on funding in the next two years, but Michigan venture capital firms have only earmarked an estimated $387 million for follow-on funding, so the additional money needs to come from both new funds raised by Michigan firms as well as out-of-state investment into Michigan. This makes outreach trips like the one to Wisconsin critical for attracting new investment dollars into the state and growing syndicate opportunities for our Michigan members.

At each of our stops, we left Wisconsin investors with our newest MVCA tools, the Entrepreneurial & Investment Landscape Map and the Landscape Guide. The 2016 MVCA Research Report provided some relevant metrics about the opportunities out-of-state investors can find in Michigan: 141 active venture-backed startups in Michigan will require more than $661 million in follow-on funding in the next two years, but Michigan venture capital firms have only earmarked an estimated $387 million for follow-on funding, so the additional money needs to come from both new funds raised by Michigan firms as well as out-of-state investment into Michigan. This makes outreach trips like the one to Wisconsin critical for attracting new investment dollars into the state and growing syndicate opportunities for our Michigan members.

Day two of our trip was the 2016 Entrepreneurs’ Conference! To put it in Michigan terms – this is Wisconsin’s version of AMIC and MGCS, combined into a day of Wisconsin greatness! Investor and entrepreneurs networked and learned best practices and it ended with a pitch competition kicked off by Wisconsin’s Governor, Scott Walker. The winner of this year’s business plan competition was Hyde Sportswear.

Day two of our trip was the 2016 Entrepreneurs’ Conference! To put it in Michigan terms – this is Wisconsin’s version of AMIC and MGCS, combined into a day of Wisconsin greatness! Investor and entrepreneurs networked and learned best practices and it ended with a pitch competition kicked off by Wisconsin’s Governor, Scott Walker. The winner of this year’s business plan competition was Hyde Sportswear.

Thank you again Wisconsin, and we hope to have you all here in Michigan soon! Next major opportunity for a visit is on November 2-3 for the MVCA Annual Dinner and the Accelerate Michigan Innovation Competition. Both are in Detroit, MI this year!